Tallarium

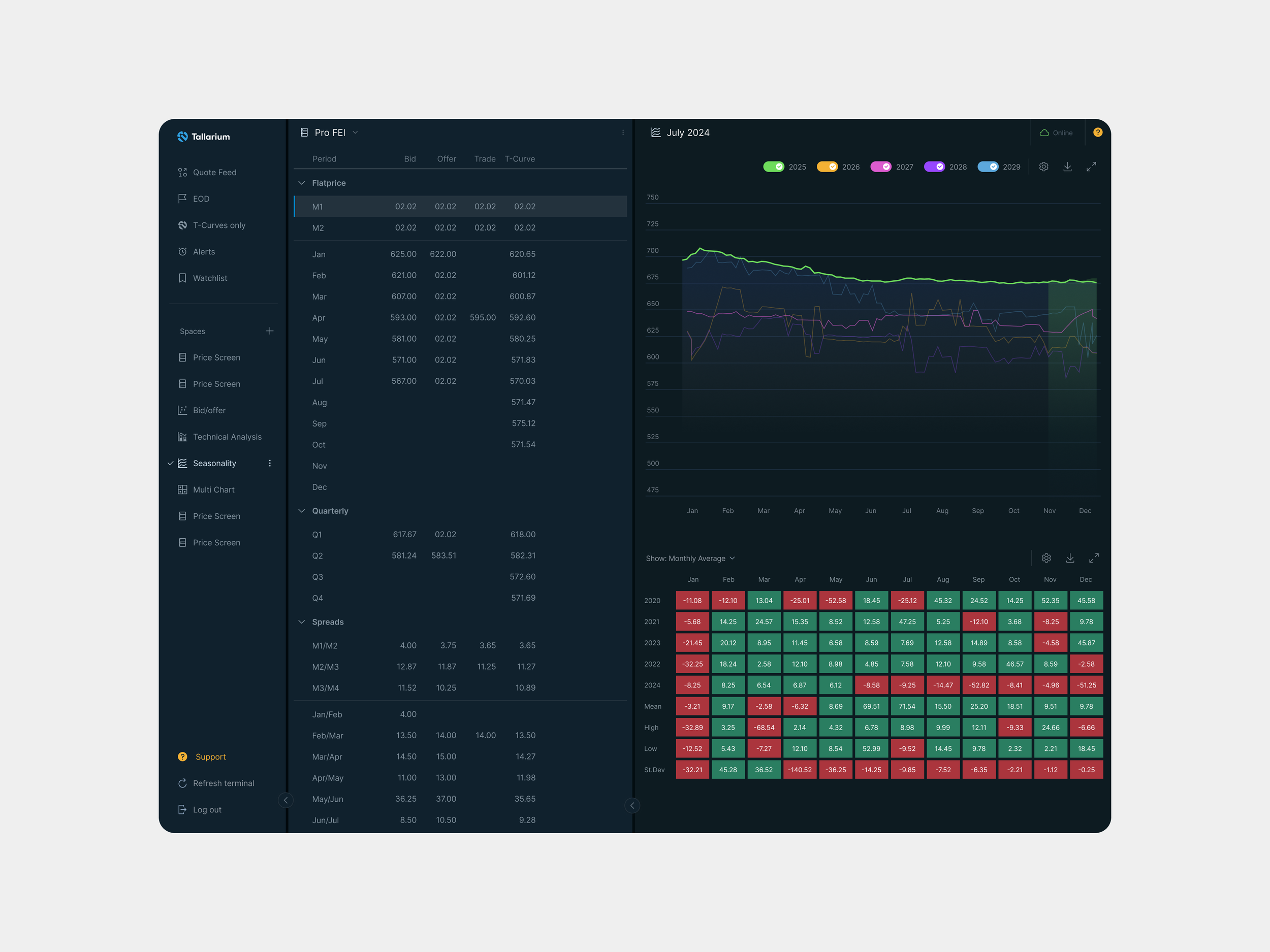

A refined UX and design system supporting Tallarium’s real-time pricing data for OTC traders, making complex market signals easier to understand and act on.

Client

Tallarium

Sector

Energy Trading

Financial Data Intelligence

B2B / SaaS

Discipline

UX Strategy

Product Design

Information Architecture

Workflow Optimisation

Data Visualisation

Microcopy

Context

Tallarium is a pre-trade intelligence platform for OTC energy markets. It converts fragmented chat and call data into structured pricing signals, giving traders a clearer view of market movements. I worked as the lead UX and UI consultant, responsible for reshaping core workflows and creating a scalable design foundation.

Challenge

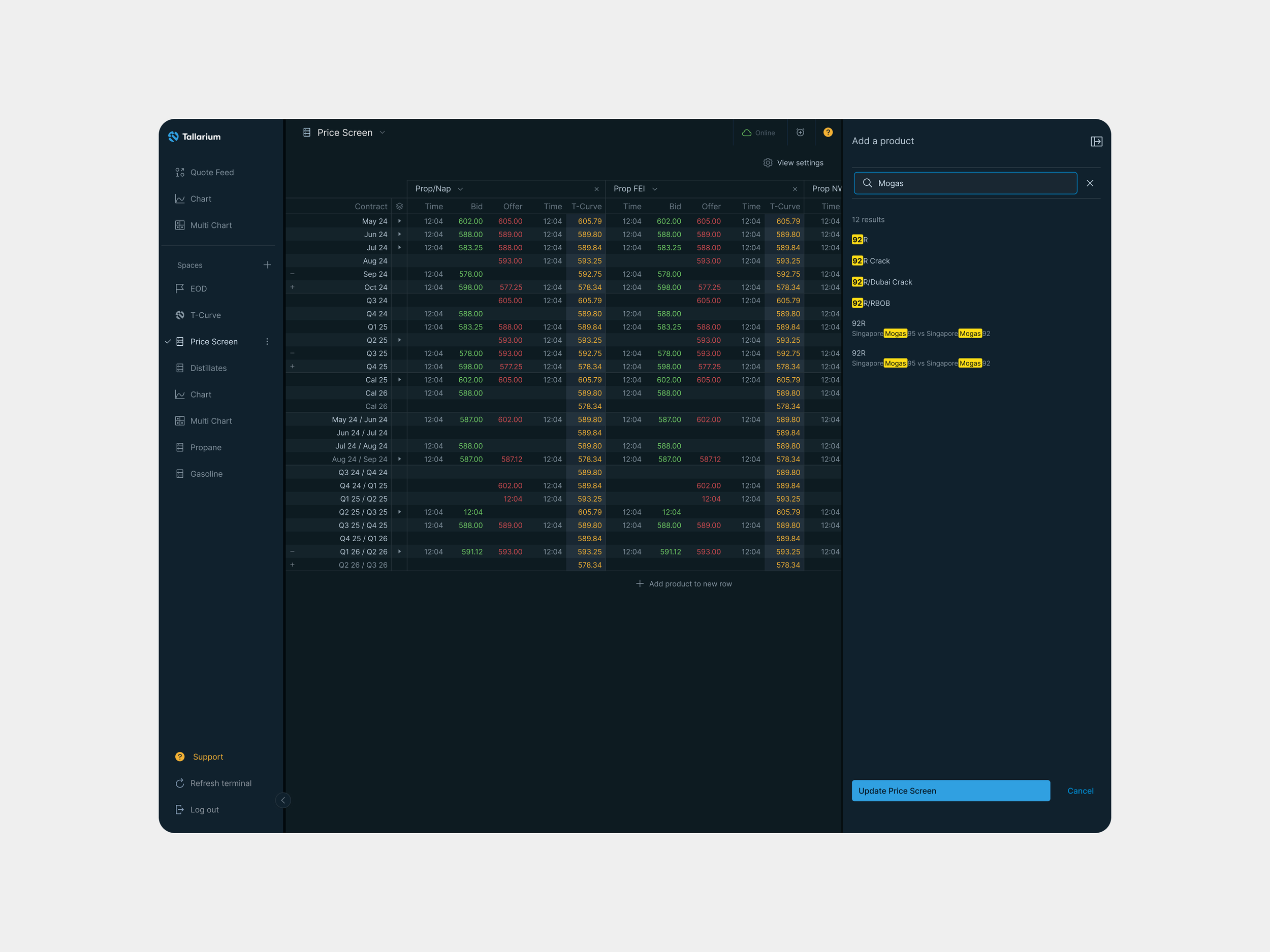

Trading desks make decisions under pressure: incomplete data, inconsistent tools, and high stakes. Tallarium’s early interface surfaced price signals, but the workflows, hierarchy, and mental models weren’t yet aligned with how traders scan, compare, and act on information.

The goal was to make the platform faster to read, easier to trust, and more predictable during live trading.

My Role

My role focused on shaping the product’s UX foundations and design system.

UX strategy across intelligence, workflow, and pricing layers

Information architecture and interaction design

High-fidelity prototypes tested with real trading desks

Collaboration with data-science and product teams

Visual system and component structure

Translating machine-extracted signals into clear, dependable UI patterns

Key Moves

Key actions that defined how the product evolved into a clearer, more dependable trading tool.

Rebuilt the information hierarchy around signals

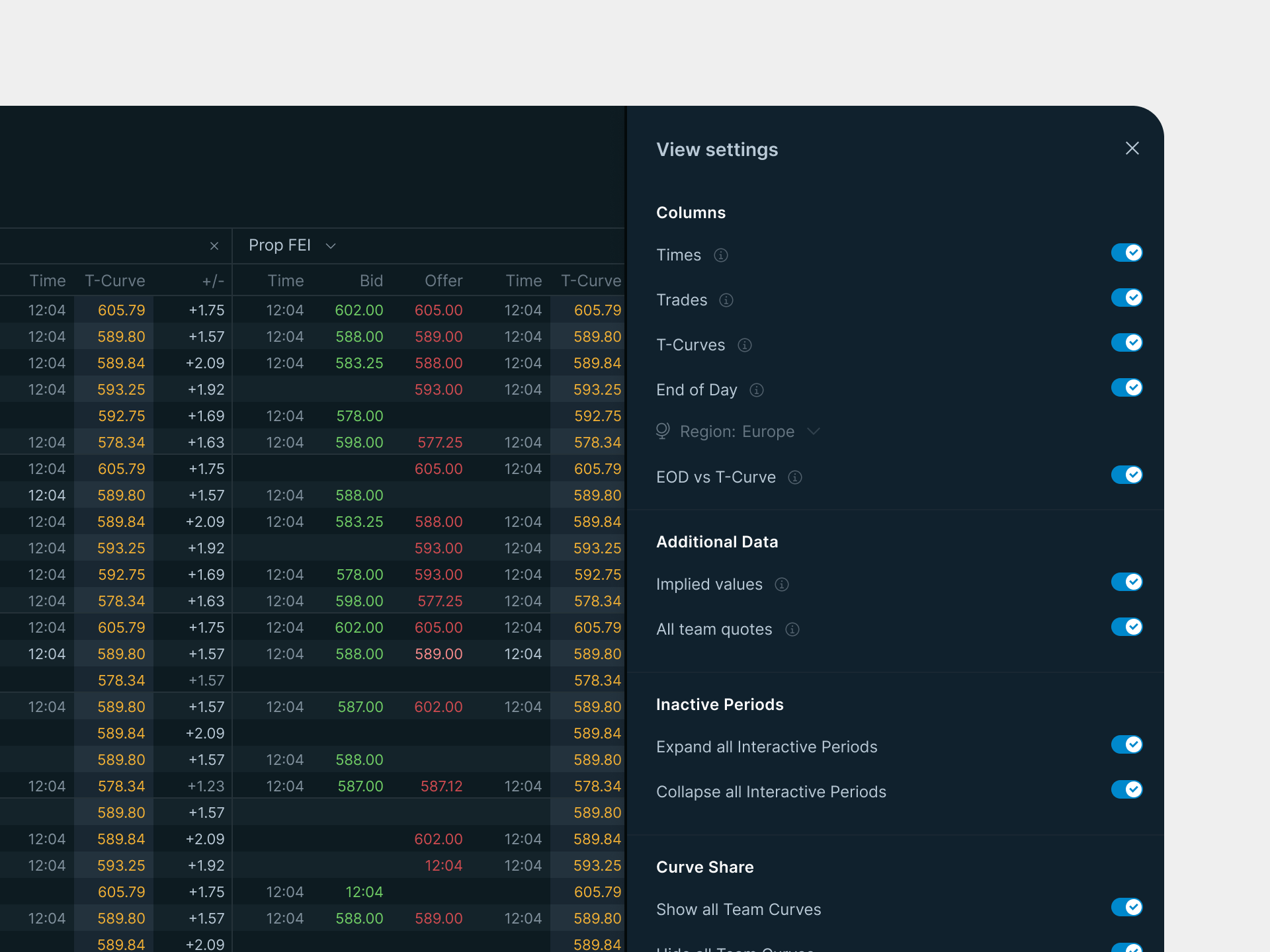

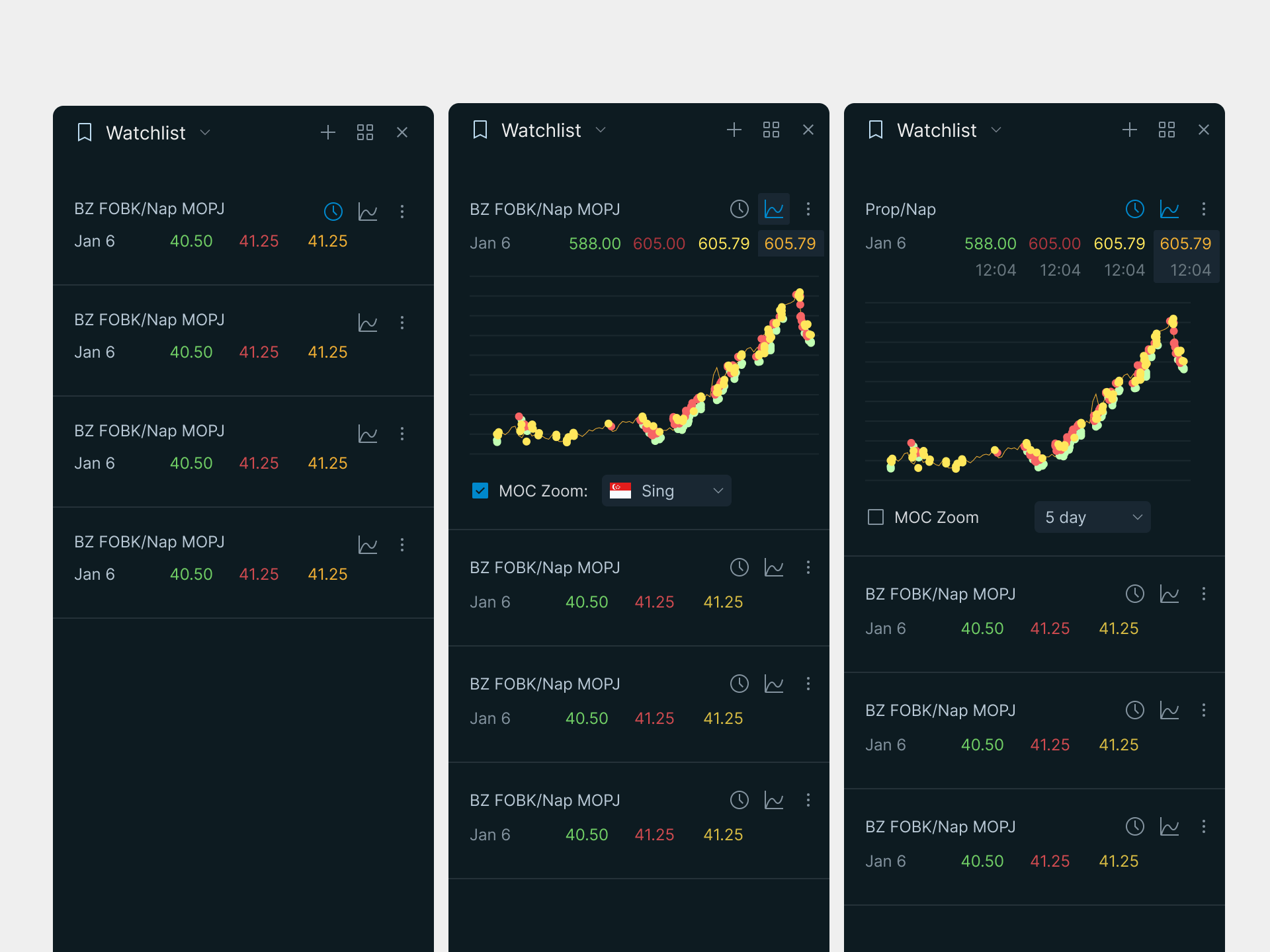

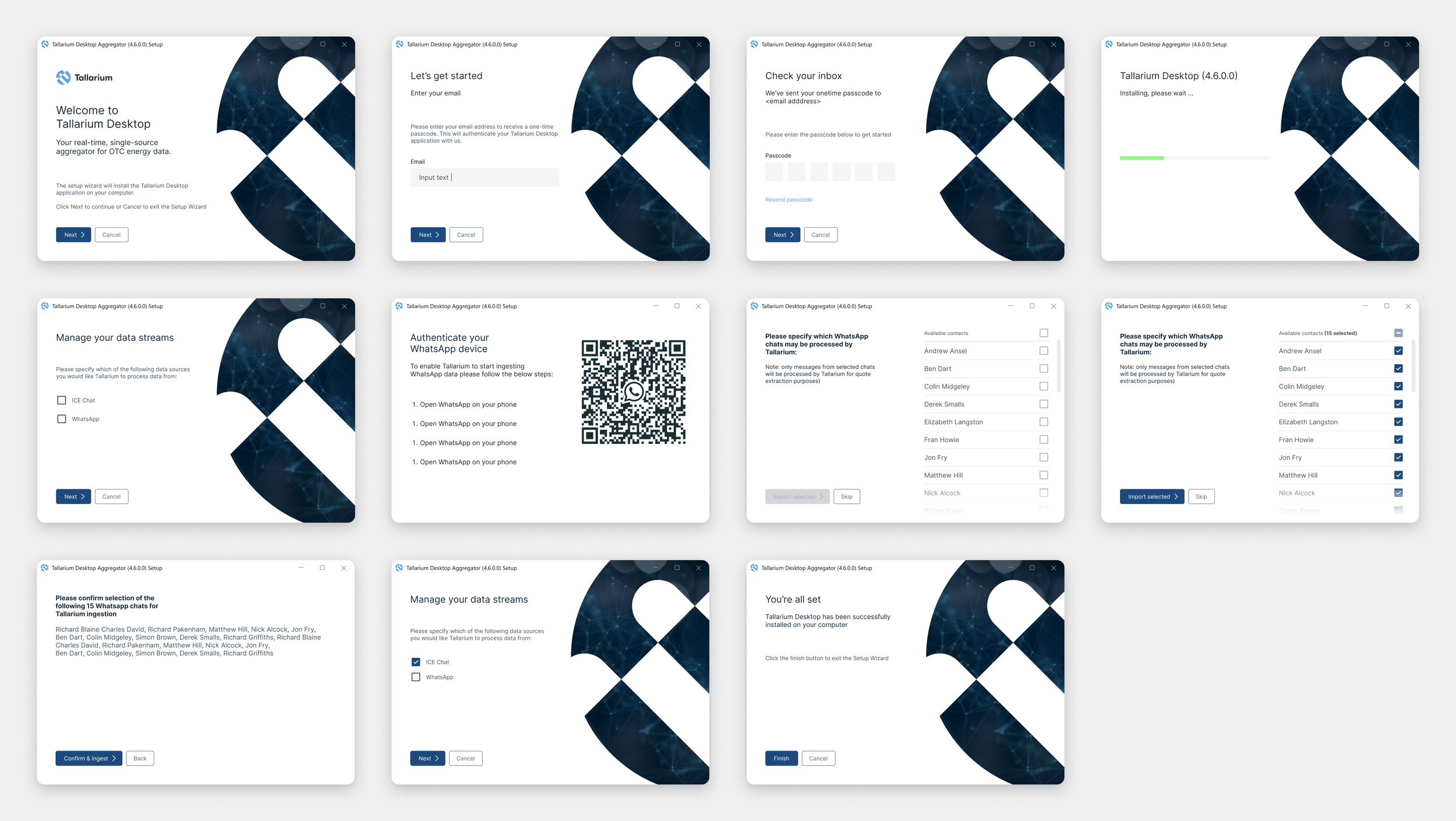

Organised the interface around the machine-derived pricing changes, anomalies, and confidence states traders care about most. Reduced noise and aligned layouts with real scanning behaviour.Redesigned workflows for speed and clarity

Simplified multi-step tasks using grouping, spacing, and progressive disclosure. Enabled traders to move between dialogue, deal terms, and price context with far less friction.Prototyped realistic trading scenarios

Created detailed interactive flows replicating live desk conditions. Tested with traders to refine data presentation, terminology, and decision-making logic.Established a scalable component and layout system

Built consistent structures for tables, cards, deal panels, and intelligence modules. This created coherence across the product and accelerated future development.Aligned data-science outputs with human mental models

Translated model behaviour into UI patterns that made pricing confidence, uncertainty, and anomalies easier to understand and harder to misinterpret.

Impact

The redesign strengthened decision-making, reduced friction, and created a solid base for future scale.

Faster comprehension of pricing signals and anomalies

Improved clarity around model-derived confidence

Reduced friction in high-pressure workflows

Stronger trust in automated insights

A cleaner, more predictable product foundation for future features

Reflection

In high-pressure environments, clarity is the product. Every decision must support faster understanding and more confident action.